Indwe Risk Services (Pty) Ltd is one of South Africa’s largest independent brokers, offering personal, business and specialist risk and insurance advisory services. It manages the insurance claim administration of numerous large listed manufacturers, retailers and prominent conglomerates. No two Indwe clients are alike. Thus, with the collaboration of thryve, it developed Lyme, […]

Every month we select our favourite reads from around the web and promote them on our social media channels, as well as a monthly blog post. In June, thryve read about POPIA’s impact on small and medium businesses, and how the cost of insurance coverage for cyber incidents is rapidly rising. We learned […]

Earlier this year, UK financial authorities published their final policy statements for operational resiliency. Though the process started in 2018, events such as the pandemic and escalating cyberattacks greatly influenced these policies. Even though organisations and financial systems have been able to get through such rough patches, it was not because they are supremely […]

Every month, we share interesting articles on our LinkedIn profiles. This month, we read about the relationship between productivity and efficiency, a debate on how banks use digital to become the trusted companies during crisis, why some SMBs are doing very well adopting digital (and why some aren’t), and that if you are still […]

Mitigating risk through the purchase of insurance is a tried-and-tested method used by organisations. But picture the day when organisations must compete with each other for insurance capacity. This may not be far away. Several different factors in the insurance world are causing capacity to shrink (hence price/premium inflation) and this may create […]

This article is part one of a series unpacking the five Call To Actions in IRMSA’s 2021 Risk Report. To learn more about the five CTAs and the report, please read this blog from thryve’s Managing Director. Integrating strategy, risk and resilience is not a new concept. Forward-looking risk experts have for years noted the […]

This article is part one of a series unpacking the five Call To Actions in IRMSA’s 2021 Risk Report. To learn more about the five CTAs and the report, please read this blog from thryve’s Managing Director. The world is flat. A few centuries ago, it would take a letter several months to reach its […]

This article is part one of a series unpacking the five Call To Actions in IRMSA’s 2021 Risk Report. To learn more about the five CTAs and the report, please read this blog from thryve’s Managing Director. Risk management roles are currently undergoing a transformation, moving from a reactive support role to a […]

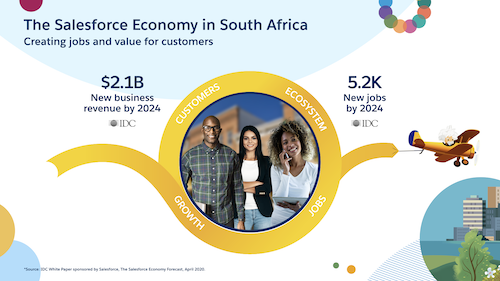

Salesforce looks to Africa for growth. Risk management starts before you even make your first hire. Analytics is complicated, but you can get it to work for you. And six considerations when choosing a Risk Management Information System. We cover these topics in our monthly selection of blogs from thryve partners – including […]

Risk management is about spotting opportunities and enabling executives to act on them. These can be positive or negative – the point of risk management exercises is to identify those elements that should concern decision-makers. It’s about understanding the likelihood of success, ensuring the goals and objectives at hand are the right ones. To reach […]